Federal judge reverses rule that would have removed medical debt from credit reports

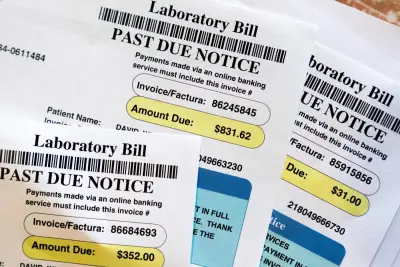

By ADRIANA MORGA and CORA LEWIS NEW YORK AP A federal judge in Texas removed a Biden-era finalized ruled by the Consumer Financial Protection Bureau that would have removed anatomical debt from credit reports Related Articles Republicans are considering changes to Trump s request for billion in spending cuts World s premier cancer institute faces crippling cuts and chaos US imposes a duty on fresh Mexican tomatoes in hopes of boosting domestic production How Trump plans to dismantle the Tuition Department after Supreme Court ruling Colorado sues Trump administration over million in withheld coaching funding U S District Court Judge Sean Jordan of Texas s Eastern District who was appointed by Trump discovered on Friday that the rule exceeded the CFPB s authority Jordan mentioned that the CFPB is not permitted to remove therapeutic debt from credit reports according to the Fair Credit Reporting Act which protects information collected by consumer reporting agencies Removing curative debts from consumer credit reports was expected to increase the credit scores of millions of families by an average of points the bureau announced The CFPB states that its research has shown outstanding healthcare proposes to be a poor predictor of an individual s ability to repay a loan yet they are often used to deny mortgage applications The three national credit reporting agencies Experian Equifax and TransUnion revealed last year that they would remove curative collections under from U S consumer credit reports The CFPB s rule was projected to ban all outstanding curative bills from appearing on credit reports and prohibit lenders from using the information The CFPB estimated the rule would have removed million in health debt from the credit reports of million Americans According to the agency one in five Americans has at least one biological debt collection account on their credit reports and over half of the collection entries on credit reports are for health debts The concern disproportionately affects people of color the CFPB has uncovered of Black people and of Latino people in the U S carry therapeutic debt versus of white people The CFPB was established by Congress after the financial predicament to monitor credit card companies mortgage providers debt collectors and other segments of the consumer finance industry Earlier this year the Trump administration requested that the agency halt nearly all its operations effectively shutting it down The Associated Press receives patronage from Charles Schwab Foundation for educational and explanatory reporting to improve financial literacy The independent foundation is separate from Charles Schwab and Co Inc The AP is solely responsible for its journalism